India is considered to be one of the most progressive countries in the world, flourishing with tremendous human resources, and a massive market. Due to these reasons, India has attracted an enormous amount of Foreign Direct Investments. These are the reasons that everyone wants to start a business in India, as it is highly beneficial to establish a business in such flourishing environment especially when the government is taking news steps like Make in India and Startup India to help the industrialization.

This article is divided into four major parts

- Standard Documents Required

- Types of Companies

- Steps to Register your company/ business

- How foreigners can start a company in India

Now let’s have a complete look at the procedure of registering a business in India step by step:

Standard Documents Required

- Copy of Pan Card of Director(s)

- Copy of Voter Id Card of Director(s)

- Copy of Aadhar Card

- 2 Passport size photo

- 6 months bank statement

- Electricity/ water bill copy of registered office

- Rent agreement if the registered office is on rent

- 1 canceled cheque

Types of Companies in India

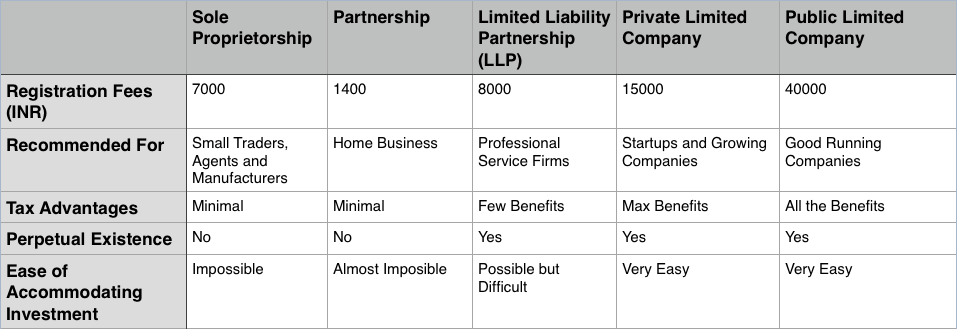

Before registering a company, it is a prerequisite to choose the type of business entity/ company a person wants to start. There are majorly 5 different types of legal entities to start a business in India. Depending upon various factors like taxation, owner liability, investment, funding, etc., you can choose any one identity which suits you the best according to the nature of your business.

1. Sole Proprietorship

a). Considered as the easiest business entity to establish which doesn’t need its PAN i.e. the PAN of owner acts as PAN for the firm.

b). Depending on the need and services provided by the firm, the business should be registered with the concerned government department.

c). The ownership of sole proprietorship can’t be transferred from one person to another; however, the assets can be sold.

d). As the owners’ assets can be attached to meet business liability claims, the proprietors have unlimited business liability.

e). As FDI (Foreign Direct Investment) is forbidden in India in the form of sole proprietorship so foreigners cannot start this.

2. Partnership

a). Governed by the Partnership Act, 1932, two or more people can form a Partnership with a maximum of 20 partners.

b). Partnership deed containing the details of the amount of capital invested by every partner, how much profit/loss each partner will share, the salary of each partner is designated. Owners of every asset are the partners of the firm.

c). Although the Income Tax Department assigns a separate PAN, the partnership doesn’t have its legal standing.

d). Partners are subjected to unlimited business liabilities and losses incurred are payable from every partner of the firm.

e). It is not necessary to register the firm with Registrar of Firms (ROF). A partnership deed is not treated as a legal document until registered with ROF, but this doesn’t stop the firm from suing someone or from someone suing firm in the court of law.

f). A foreigner cannot start a Partnership firm also.

3. Limited Liability Partnership (LLP)

a). Established by an Act of the Parliament, LLP allows members to retain the flexibility of ownership similar to Partnership Firms but also provides liability protection.

b). The extent of investment decides the maximum liability of each partner in an LLP.

c). It has its PAN and legal status.

d). It protects partners against illegal and unauthorized actions of other partners.

e). If the total number of investors are more than seven than the foreign promoter can opt for the Limited company, but the company would have to raise equity funds from an abundance of shareholders.

f). FDI in LLP requires prior approval from the Reserve Bank of India.

4. Private Limited (Pvt. Ltd.)Company

a. It allows its owners to subscribe to its shares by paying a share capital fee.

b. It is a separate legal entity both in terms of taxation as well as liability. The share capital is the deciding factor for the personal liability of the shareholders.

c. Register the company name with the appropriate Registrar of Companies (ROC).

d). The article of Association and draft of Memorandum of Association are prepared and signed by promoters (initial shareholders) of the company. It can have between 2 to 200 members (can be individuals or even corporate entities) with a minimum share capital of Rs. 1, 00,000.>

e). Minimum of 2 directors and a maximum of seven directors are appointed by the shareholders to look after the daily affairs of the company. It is recommended that one director be an Indian Citizen and Indian Resident (living in India for over 186 days) while other board members can be of any nationality or residency.

f). It has more compliance burden as compared to Partnership and LLP. Accounts of the company must be maintained according to Income Tax as well as Companies Act. It is a very tedious job when it comes to closing the company but the shareholders can change without affecting the operational or legal standing of the company.

g). It allows a high degree of separation between ownership and operations, thus allowing investors to exit by selling shares without being liable for company affairs.

5. Public Limited Company

a). Similar to Pvt. Ltd. Company but the number of shareholders can be unlimited with a minimum of seven members.

b). It is generally complicated to establish and can be either listed on a stock exchange or remain unlisted. The shareholders of a listed Public Ltd. Company can trade their share freely on the stock exchange.

c). A Public Ltd. Company requires more public revelations and compliance from the government along with market regular SEBI (Securities and Exchange Board of India) including the appointment of autonomous directors on the board, public revelations of books of accounts, maximum limit on salaries of Directors and CEO.

d). It is an independent legal business whose existence is not affected by death, retirement or insolvency of any of its shareholders.

Steps to Register a Company

After deciding which type of business entity you want to form now to need to register it with all the legal approvals.

1. The first step is you need to hire any Chartered Accountant/ Lawyer of India because he is familiar with all the rules, processes, and fees. I would suggest you to hire a Chartered Accountant(CA) instead of Lawyer because he knows company laws better than a lawyer.

2. Then the proposed directors should get the Digital Signature Certificate (DSC) and also request for Director’s Identification Number (DIN) which requires the ID and address proofs of the proposed directors. If you are a Foreign National/NRI, you must submit a self-attested and notarized copy of your passport and an address proof (Driver’s License, Utility Bill, Residency Card).

3. Enroll for Service Tax, VAT/Sales Tax, excise duty (check applicability), Shop and Establishment Act, Customs duty, apply for TAN and file Entrepreneurship Memorandum at DIC (Optional).

4. Find out about state specific guidelines and procedures; take all the permissions/ licenses required at the construction stage; do post construction clearances, and ensure that the employees are registered under Employee State Insurance (ESI) Scheme and Employee’s Provident Fund.

5. For registering an office for the company, an NRI/Foreign Resident requires electricity bill/property tax receipts/gas bill and a No Objection Certificate from the owner of that office. If you are an NRI, you need to get a PAN Card issued in your name from the income-tax dept. Get an OCI card issued in your name as it entitles you to some benefits which are extended to an Indian citizen as far as business and tax issues are concerned.

6. Ensure that the company is a member of all the business organizations related to the sector it is engaged in. If it is an export/import business, register yourself with the Director General of Foreign Trade which requires a bank account number and a letter from the bank along with details of partners/directors.

Steps by which Foreigner can Register a Company in India

There are mainly two ways through which foreign business can enter in India. First is the registration of a company which is the fastest and easiest way of entry as it requires no special permission from the Central Government of India. Secondly, one can opt to register branch office, project office, or liaison office, which essentially requires RBI and Government approval and certainly more cost and time.

If you are a foreigner, then the copy of documents should be notarized by the Indian embassy in the respective country or home country. Foreign nationals have the flexibility of establishing and operating a business in India without traveling to India. After incorporation of the company, Indian director can open a bank account in the newly incorporated company’s name after which FDI flow must be reported to Reserve Bank of India. It should be ensured that your business is in proper agreement with all the mandatory regulations in India. For a better understanding regarding the scopes of different sectors, you can also read the effect of Make in India.

The cost and time required for registration of a company in India are nominal, thus making India a comfortable place to start a business. Furthermore, the Indian government is making a continuous attempt to make the process of doing business in India hassle-free.

![12 Ways to Increase Profits of Your Business [2021]](https://www.businessalligators.com/wp-content/uploads/2018/03/girl-working.jpeg)

I am Prasad, I want to start detergent powder manufacturing with 2 lakhs. Please tell me how can I start?

Honest guidance.

I want to start a notebook manufacturing company. Please tell me how to start.